Fiscal Year 2025 Calendar: A Comprehensive Guide

Related Articles: Fiscal Year 2025 Calendar: A Comprehensive Guide

- 2025 Printable Calendar With Bank Holidays: A Comprehensive Guide For Planning

- March 2025 Calendar With Zodiac Signs

- Vigo County School Calendar: A Comprehensive Guide

- School Calendar For 2025 Queensland: A Comprehensive Guide

- Free Printable May 2025 Calendar: Plan Your Month With Ease

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Fiscal Year 2025 Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Year 2025 Calendar: A Comprehensive Guide

Fiscal Year 2025 Calendar: A Comprehensive Guide

Introduction

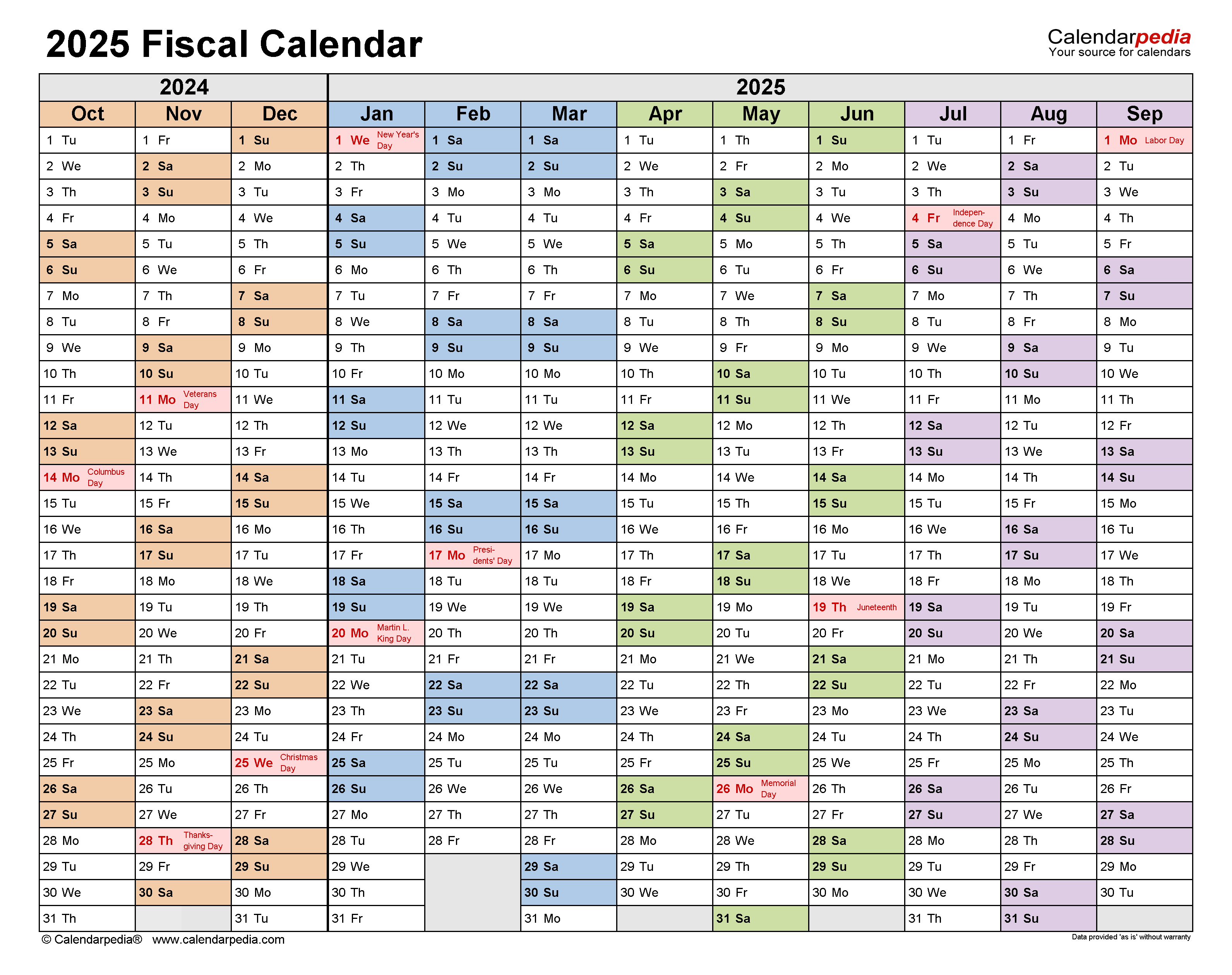

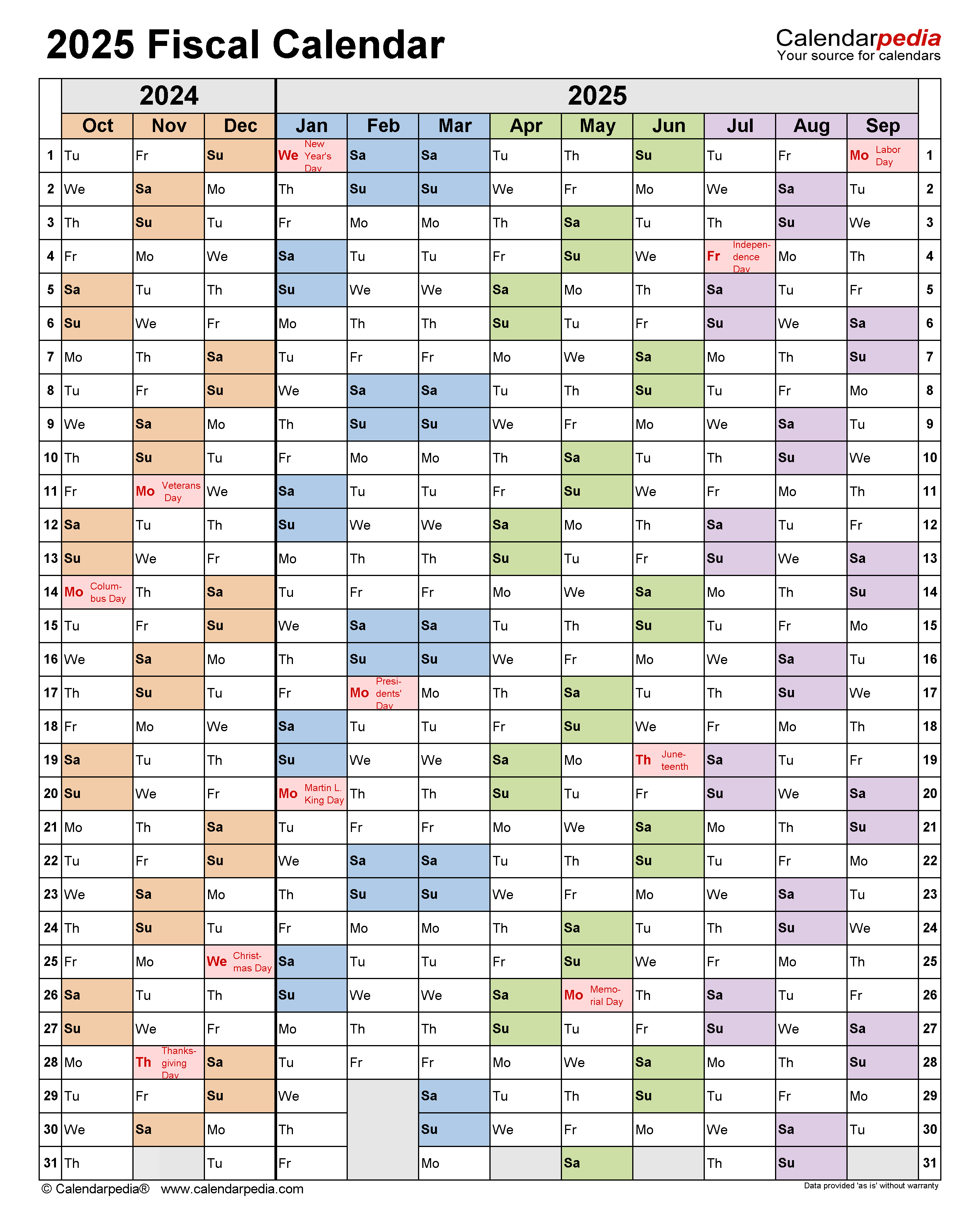

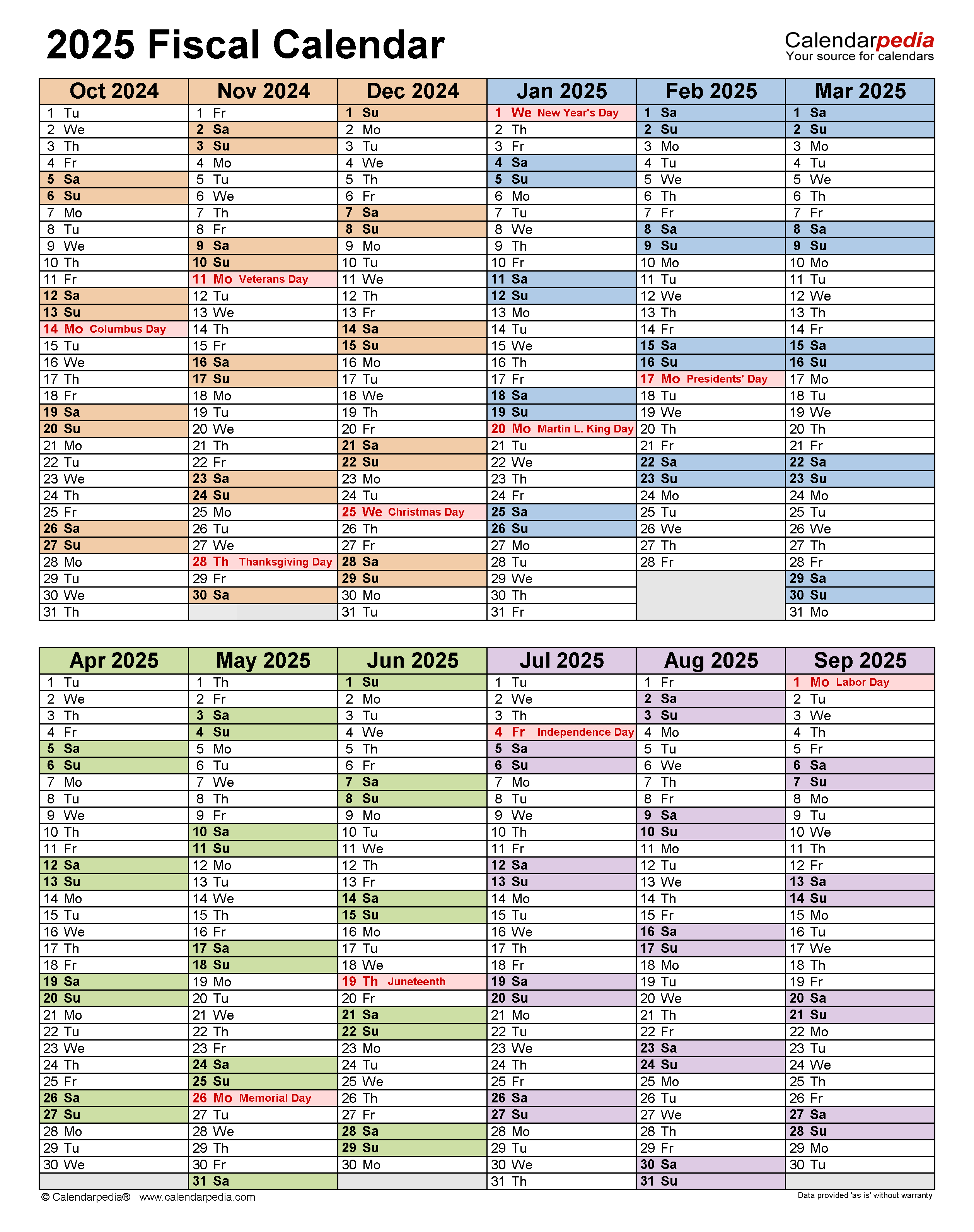

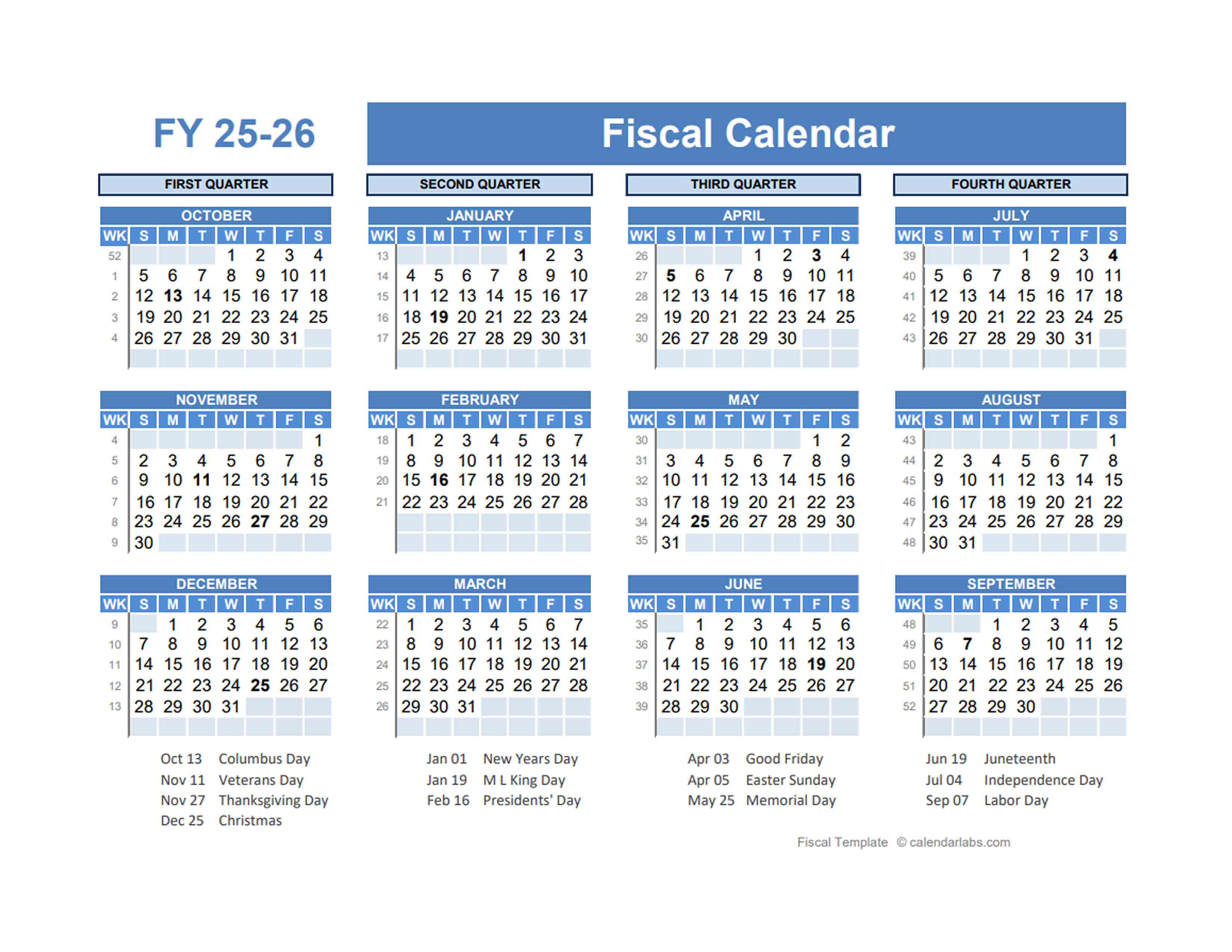

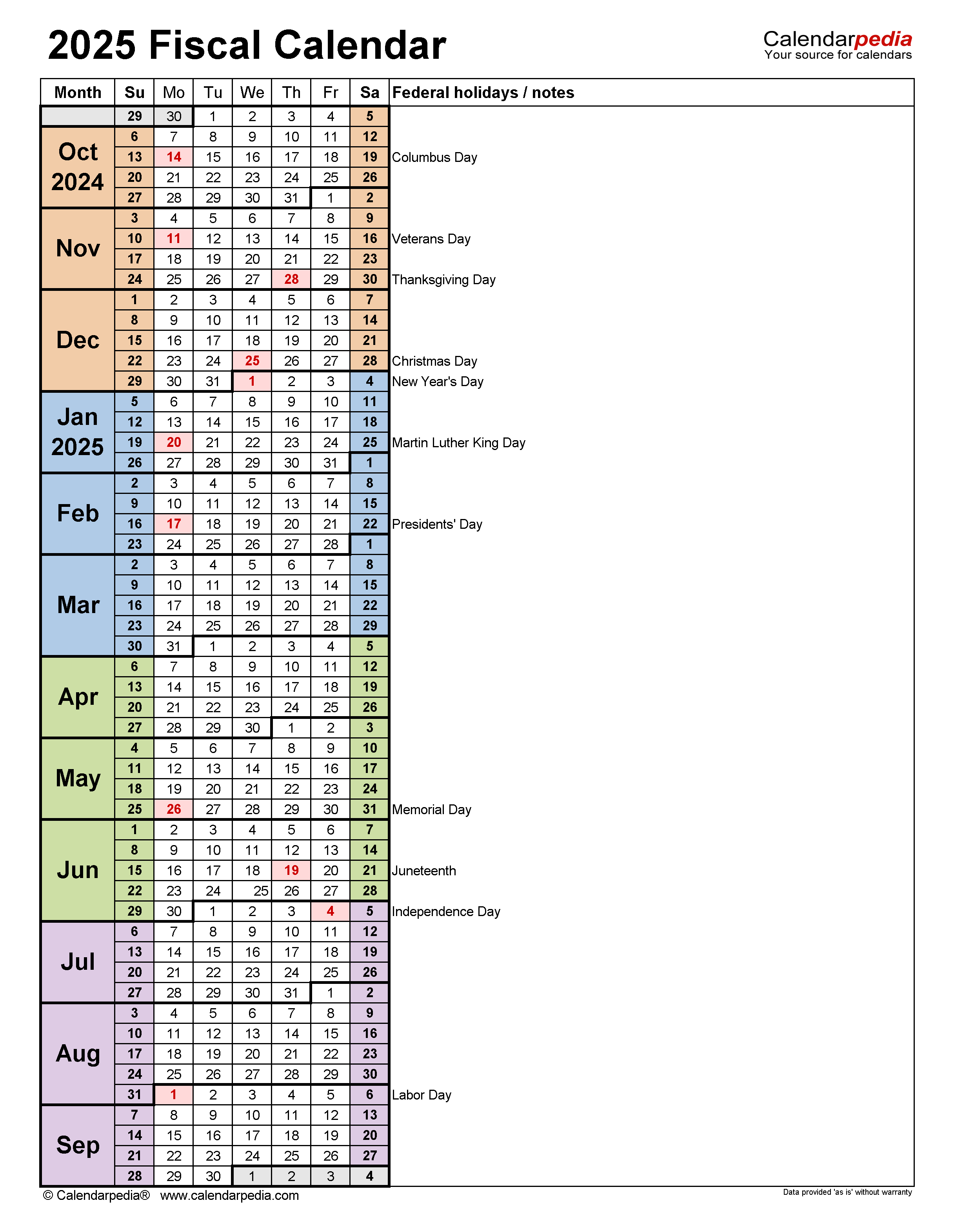

The fiscal year (FY) is a 12-month period used by governments, businesses, and other organizations to track their financial activities. The fiscal year does not necessarily align with the calendar year, and it can vary depending on the organization’s needs and preferences.

The fiscal year 2025 (FY2025) will begin on October 1, 2024, and end on September 30, 2025. This article provides a comprehensive guide to the FY2025 calendar, including important dates and deadlines.

Important Dates and Deadlines

The following are some of the most important dates and deadlines for FY2025:

- October 1, 2024: Beginning of FY2025

- December 31, 2024: End of the first quarter of FY2025

- March 31, 2025: End of the second quarter of FY2025

- June 30, 2025: End of the third quarter of FY2025

- September 30, 2025: End of FY2025

Holidays

The following are the federal holidays that will be observed during FY2025:

- New Year’s Day: January 1, 2025

- Martin Luther King, Jr. Day: January 20, 2025

- Washington’s Birthday: February 17, 2025

- Memorial Day: May 26, 2025

- Independence Day: July 4, 2025

- Labor Day: September 1, 2025

- Columbus Day: October 13, 2025

- Veterans Day: November 11, 2025

- Thanksgiving Day: November 27, 2025

- Christmas Day: December 25, 2025

Tax Deadlines

The following are the important tax deadlines for FY2025:

- April 15, 2025: Individual income tax returns due

- April 15, 2025: Business income tax returns due

- June 15, 2025: Estimated tax payments due for the second quarter of FY2025

- September 15, 2025: Estimated tax payments due for the third quarter of FY2025

- January 15, 2026: Estimated tax payments due for the fourth quarter of FY2025

Planning for FY2025

Organizations should begin planning for FY2025 as early as possible. This includes developing a budget, setting goals, and identifying any potential challenges. By planning ahead, organizations can ensure a smooth and successful fiscal year.

Conclusion

The fiscal year 2025 calendar is an important tool for organizations of all sizes. By understanding the important dates and deadlines, organizations can plan ahead and ensure a successful fiscal year.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Year 2025 Calendar: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!