Regulation Z Calendar 2025: A Comprehensive Guide

Related Articles: Regulation Z Calendar 2025: A Comprehensive Guide

- 2025 Yearly Calendar Printable: A Comprehensive Guide For A Well-Organized Year

- Countryfile Calendar 2025: Order By Post

- Maldives Calendar 2025: A Comprehensive Guide

- November 2025 Calendar Holidays: A Comprehensive Guide

- Christian Wall Calendar 2025: A Devotional Guide For Daily Inspiration

Introduction

With great pleasure, we will explore the intriguing topic related to Regulation Z Calendar 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Regulation Z Calendar 2025: A Comprehensive Guide

Regulation Z Calendar 2025: A Comprehensive Guide

Introduction

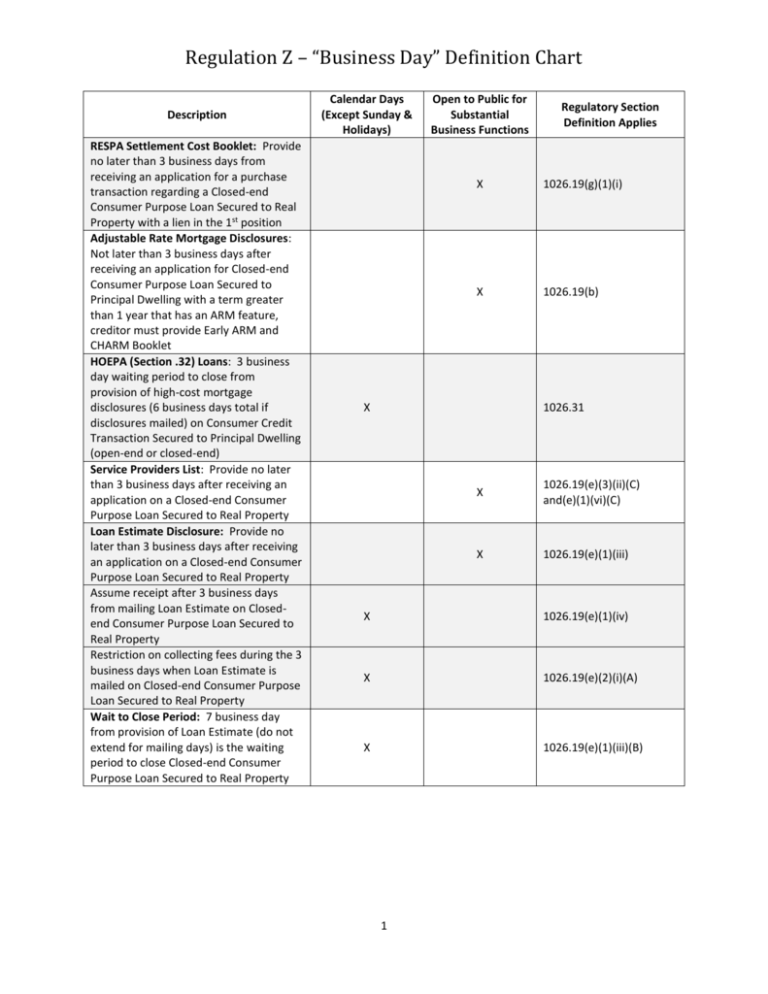

Regulation Z, also known as the Truth in Lending Act (TILA), is a federal law that protects consumers in credit transactions. It requires lenders to provide borrowers with clear and concise information about the terms of their loans, including the annual percentage rate (APR), finance charges, and payment schedule.

The Regulation Z calendar is a tool that helps lenders comply with the law. It provides a list of the key dates and deadlines that lenders must meet when making disclosures to borrowers.

Key Dates and Deadlines

The following are the key dates and deadlines that lenders must meet under Regulation Z:

- Pre-loan disclosures: Lenders must provide borrowers with a loan estimate within three business days of receiving a loan application. The loan estimate must include the APR, finance charges, and payment schedule.

- Closing disclosures: Lenders must provide borrowers with a closing disclosure at least three business days before the loan is consummated. The closing disclosure must include the final loan terms, including the APR, finance charges, and payment schedule.

- Periodic statements: Lenders must provide borrowers with periodic statements at least once per year. The periodic statements must include the current balance, the amount of interest that has been paid, and the remaining balance.

Penalties for Noncompliance

Lenders who fail to comply with Regulation Z may be subject to civil penalties. The penalties can range from $2,000 to $25,000 per violation.

2025 Regulation Z Calendar

The following is the 2025 Regulation Z calendar:

- January 1: Lenders must begin using the new 2025 loan estimate form.

- April 1: Lenders must begin using the new 2025 closing disclosure form.

- July 1: Lenders must begin using the new 2025 periodic statement form.

Conclusion

The Regulation Z calendar is a valuable tool for lenders who want to comply with the law. By following the calendar, lenders can avoid penalties and ensure that borrowers are provided with the information they need to make informed decisions about their loans.

Closure

Thus, we hope this article has provided valuable insights into Regulation Z Calendar 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!